As the name implies, the theme of Workday’s AI and ML Innovation Summit 2023 for industry analysts (held March 13-15 at beautiful Cavallo Point in Sausalito, CA) was artificial intelligence (AI) and machine learning (ML). While other ground was covered, AI and ML topics were the centerpiece of most of the presentations and discussions.

Co-CEOs Aneel Bhusri and Carl Eschenbach set the stage with an opening fireside chat. They discussed new ways to envision and apply artificial intelligence (AI) and machine learning (ML) capabilities in their human capital management and financial solutions. Sayan Chakraborty, Co-President for Workday’s product and technology organization, followed with an overview of these technologies, and a discussion of why and how they are critical to future Workday innovations. This theme continued to anchor the rest of the sessions during the event.

Unlike a customer-focused event, which is typically chock-full of product announcements, most of the sessions—especially on the first day—were more strategic. This was also one of the most interactive analyst events I’ve attended, with plenty of time allocated for questions and comments throughout.

While it’s always difficult to sum up a couple of days of sessions in a blog post, here are my top takeaways—featuring, but not limited to the AI and ML theme.

The shift to Carl Eschenbach as co-CEO is on track

Workday appointed Carl Eschenbach as co-CEO to serve alongside Aneel Bhusri, the company’s founder, in December 2022. Plans are for Eschenbach to become the sole CEO at the end of January 2024, when Bhusri will move to a full-time role as Executive Chair. Eschenbach’s experience at venture capital firms, executive roles at industry-leading tech firms, and as a board member for several tech companies should be a great fit to help guide Workday’s strategy forward. Bhusri is excited about the shift, saying he is already spending more of his time on products and technology as Eschenbach assumes more responsibility for the business side of things.

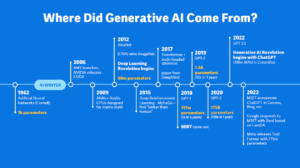

Generative AI is “everywhere, everything, all at once” as a result of a 60-year journey

Chakraborty provided a great primer on the history of generative AI. Although Microsoft’s recent deal to embed Open AI’s ChatGPT technology into Bing and Office has thrust generative AI into the spotlight, the history dates back several decades to the first iterations of large language models (which are trained on vast amounts of text). This is enabling many more people to kick the tires—and accelerating the now rapid innovation in this area.

Workday is infusing AI and ML innovations throughout its applications and platform

The vendor has been embedding these transformative technologies across its solutions portfolio for several years, and pressing harder on the gas pedal. It sees these technologies as essential to satisfying customers’ needs for fast access to real-time data and analytics.

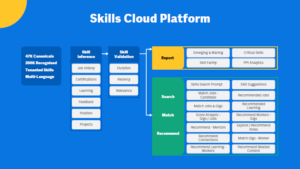

Chakraborty discussed Workday’s four focal points for innovation, which are data management, intelligence and auto ML, the platform surrounding everything, and privacy embedded in everything. For Workday, all these areas are interconnected. Unlike some other vendors, it doesn’t view AI and Ml capabilities as separate add-ons or SKUs, or charge extra for them. Instead, it is infusing these capabilities into its applications. The vendor is probably farthest along in this regard with its Skills Cloud, but it provided many examples of how it’s bringing these capabilities into its other solutions. The vendor is also making its AI and ML resources available within Workday Extend, the PaaS component of Workday that provides developer tooling for partners and customers to build, deploy, & manage new applications.

Generative AI is all about patterns and math

Chakraborty described generative AI as being “very good at searching and examining data to find patterns; summarizing data using patterns identified in search; creating personalized content based on patterns; and making predictions using patterns for modeling and scenario planning.” However, because “it’s just math,” Chakraborty says it’s also probably impossible to regulate–opening the door to potential unintended negative consequences–such as bad results, lack of explainability, and bad actors that bias the algorithms and data. Of course, these negative consequences are much more likely to occur in broad-based, consumer applications trained on consumer data than in business applications, which are trained on data that its customers give it permission to use. Regardless of the source, however, generative AI also burns up a lot of computing power, and therefore, energy (though not as much as crypto mining).

Of course, generative AI can be used for good or nefarious purposes–just like with social media and other technologies. At this point, more broad-based trial balloons (e.g., in Microsoft Bing and ChatGPT, and Google Bard) seem like the Wild West. But business application vendors such as Workday must protect their customers’ sensitive data, and their algorithms must be more reliable, explainable, and trustworthy.

Execs made the point that Workday is a data processor and that the customers own their data and decide how they want to use it. However, they also emphasized the need for customers to understand the algorithms. In my mind, this puts the onus on Workday and other vendors to make sure that they provide clear, accessible explanations about how their algorithms are constructed.

Growth priorities include cross-selling opportunities, medium enterprises, and international markets

Large enterprises are Workday’s bread and butter; Over half of the Fortune 500 companies are already Workday customers, and Bhusri thinks this will reach the 75% mark. Ale Mayer, SVP of Corporate Strategy and Business Operations, discussed how Workday is pursuing other growth opportunities:

- Building a better story to help step existing customers through its portfolio. With 24 solutions just in its HR portfolio, Workday must make it easier for its existing 10,000+ customers to step through its portfolio. To that end, Workday is creating “value journeys” to group different solutions together and explain the value of doing more with Workday.

- Growing share in the medium business sector. Workday’s definition of “medium business” is companies with 500-3,499 employees. (This definition of medium business goes much further up the food chain than most other tech vendors, who typically put 500 or 1,000 employees at the upper end of the medium business bracket). Workday noted that half of its North American sales are coming from this segment and that it is seeing strong growth here. Workday introduced packaging, tools, and templating a few years ago to reduce implementation costs for medium businesses and said that it is hiring more quota-carrying sales reps on board to focus here. One of the big plusses for Workday here is that these businesses are more likely than large enterprises to have a single buyer that will buy the platform, instead of just financials or HR. As you’d expect, small businesses with less than 500 employees continue to be off of Workday’s radar, except for opportunistic exceptions. This is a good decision as Workday’s solutions are overkill for most smaller companies in terms of functionality, price, and complexity.

- International expansion, targeting Canada, UK, France, Germany, and Australia. Like most U.S. software vendors, Workday has identified these countries as the best fit for international expansion. The BRIC countries and other emerging markets with large and growing economies are not currently a priority, due to issues such as customers’ “willingness to pay,” and the resources required to localize products and operations in these countries. This may prove to be a risky move over time, as other companies home in on these markets and become difficult to displace. On the other hand, there’s a good case to be made for spreading yourself too thin. A case in point is Intuit, which recently exited India after investing in the market for ten years. It found it too difficult to compete with other accounting software products, where many competitors offered solutions at cheaper price points than QuickBooks Online, and provided desktop solutions for Indian customers not ready to go to the cloud.

Also of note

Workday executives covered many other aspects of their plans in depth, including:

- Progress and plans to improve user experience. The vendor is using AI and ML to personalize the interface. It is also bringing more tasks to the mobile interface, and integrating with collaboration apps, such as Slack and Microsoft Teams. I thought it was pretty impressive that the vendor gave customers one year to opt-in to their most recent UI upgrade—and succeeded in transitioning all of its 10,000+ customers and over 60 million users in that timeframe.

- An overview of Workday security practices. When you are responsible for protecting the security of over 60 million users, trust is a top priority. Workday’s security strategy encompasses many initiatives, from the NIST cybersecurity framework to Zero Trust to Shift Left; penetration tests with customers, partners, and ethical hackers; and providing partners and customers using its Extend proprietary development platform with the same security profile as Workday developers.

- Workday is expanding opportunities for customers and partners to build on its platform. Workday introduced Extend, its low-code development tooling (built on the Workday platform) for partners and customers in 2020. In March 2023, it introduced App Builder, a web-based tool to further simplify development. Over the next year, Workday will add low-code/no-code visual capabilities to App Builder, enabling developers to build apps without writing any code. It also plans to introduce Workday Graph API for developers using Workday Extend, which will help them to navigate and discover Workday APIs more easily.

- Workday covered a lot of ground in product updates for its HR and Financials portfolios. While they are too numerous to cover here, a couple of things stood out. Workday will be providing more industry flavor in its solutions. One example is building out inventory capabilities in Financials so that nurses can easily order supplies. Workday also has a huge opportunity with VNDLY, which it acquired in December 2021. VNDLY helps businesses manage their contingent (non-employee) workforce. VNDLY was fully integrated with Workday prior to the acquisition and can provide customers with a consistent platform, system, and processes to manage both employees and contingent workers. According to Staffing Industry Analysts, the average percentage of workers who are contingent is expected to grow to 29 percent by 2030–providing Workday with a significant cross-selling opportunity.

Perspective

This wasn’t my first Workday analyst event, and hopefully won’t be my last. But the interactive format of this one left me with a much deeper understanding of Workday’s strategy.

Although it has nothing to do with AI, ML, or technology, I also want to tip my hat to Workday’s AR crew, who in my opinion is one of the most friendly, helpful, and professional AR teams in the industry–in my view, a good reflection of the overall vibe I get about the Workday culture.

Workday is not trying to be all things to all people. It’s not (at least for now) planning to get into CRM, target small businesses, or go after the market in India or Brazil. Instead, Workday is laser-focused on building on its core strengths–continuing to build out the platform for Finance and HR, leveraging AI and ML, and other technologies to provide greater value and a better user experience and extend development opportunities to fill in gaps.

All of this makes it no surprise that at a time when many big tech companies are laying off and reporting less than stellar results, Workday delivered solid growth with its fourth quarter and full-year fiscal 2023 results. The strategy the company outlined during this year’s Summit leads me to believe that Workday will continue to fare well, despite the volatility swirling around us.

© SMB Group, 2023

Workday is an SMB Group client.