What are the key trends and challenges that SMB financial professionals are facing, and how are they impacting business and financial management practices? These are the questions we explore in this new report, 2023 State of Finance Automation: SMB Financial Management Insights & Trends.

The insights in the report are based on BILL’s State of Finance Automation market study, conducted by SMB Group, which surveyed 750 SMB financial decision-makers in small, midsize, and midmarket businesses in the U.S. with 50-500 employees. We asked respondents questions that spanned from the impact of macroeconomic trends to hybrid work functions to automation, as well as polling their thoughts on emerging, integrated finance technologies.

Examples of some of the key findings we share include:

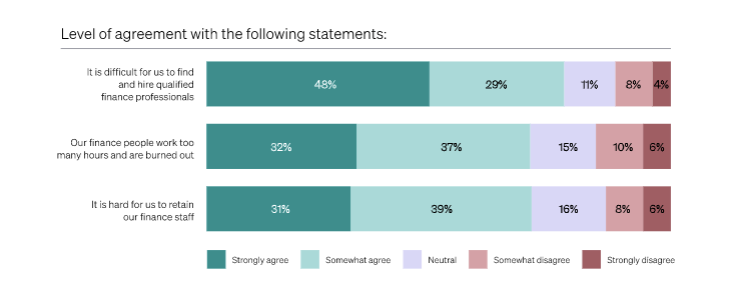

- More than three-quarters of respondents agreed that they’re facing difficulties finding and hiring qualified finance professionals, and about two-thirds agreed it’s hard to retain their staff, and that finance people work too many hours and are burned out.

- Over three-quarters of respondents agreed with several statements that affirm that financial professionals and finance teams are being tasked with more strategic and analytical functions.

- More than 80% of respondents agreed that automation plays a critical role in managing financials on a day-to-day basis, and that financial management automation solutions can help them achieve more strategic goals, such as improving business insights and attracting and retaining qualified talent.

Of course, there’s much more information and detail in the report. And if you prefer to tune in to a presentation, I’ll also be discussing these findings in this webinar, co-hosted with BILL, on April 25. Attendees of the live webinar have the opportunity to earn CPE credit.

© SMB Group, 2023