This is part one of a two-part blog series discussing Dell’s strategy to help SMBs better capitalize on technology. This first post provides perspectives from Dell World 2014. The second post, Dell’s Strategy to Provide Game Changing Technologies to SMBs, provides a detailed glimpse into Dell’s approach in the SMB market.

How has Dell changed since Michael Dell took Dell private a year ago? A couple of weeks ago, I had the opportunity to attend Dell World 2014 in Austin and find out. As I’ve written in past posts about prior Dell Worlds, the transformation has been underway for several years, since Michael Dell embarked on his strategy to transition Dell from a hardware-centric company to an end-to-end solutions provider.

How has Dell changed since Michael Dell took Dell private a year ago? A couple of weeks ago, I had the opportunity to attend Dell World 2014 in Austin and find out. As I’ve written in past posts about prior Dell Worlds, the transformation has been underway for several years, since Michael Dell embarked on his strategy to transition Dell from a hardware-centric company to an end-to-end solutions provider.

As a private company, Dell is no longer obliged to disclose financial metrics. But, unleashed from Wall Street’s quarterly pressures, Dell appears to be making excellent progress on its goals. For instance, Dell has broadened its software and service portfolios, and claims significant growth in both areas. According to IDC, Dell is also increasing hardware market share no doubt aided in part by competitors HP and IBM. With IBM exiting the x86 server market, and HP’s recent decision to split itself into two companies (one focused on PCs and printers, the other on servers, software and services) Dell is the only vendor left that supplies an end-to-end desktop to data center portfolio. Meanwhile, Dell has evolved to become a significant force in the channel, with 40% of its sales now going through channel partners.

Dell’s New Cloud Marketplace

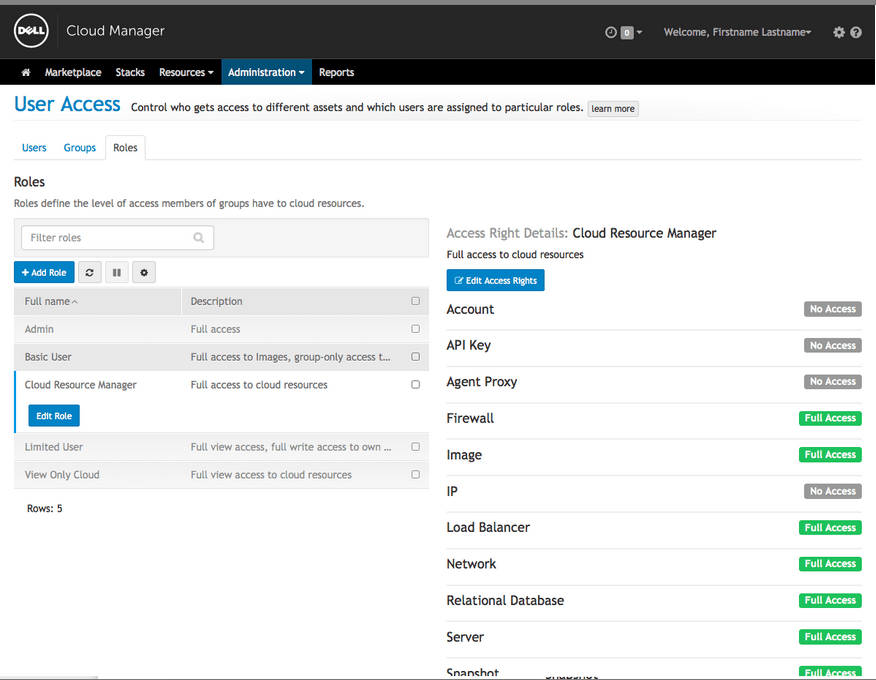

One of the most interesting announcements at the event was the beta launch of the Dell Cloud Marketplace, which distinguishes itself from many other cloud vendors by offering customers choice. In Dell’s brokerage model, the vendor provides customers with a one-stop shop from which they can select and manage cloud services from multiple vendors, including Amazon, Google, Joyent and Microsoft. The marketplace is built on technologies from Dell’s Cloud Manager, which Dell acquired from Enstratius in 2013. Key technology partners include Delphix, which supplies data migration services; Pertino, for cloud networking; and Docker, for container and portability services. Dell is also partnering with Foglight to provide developers with tools to improve cloud-based application performance.

Dell Cloud Marketplace is tuned to the different needs of IT managers and developers. IT managers get a single console from which they can provision, manage and integrate private, public and hybrid could services. Meanwhile, developers can get instant, self-service access to cloud services. The concept appealed to conference attendees, with over 400 signing up for the beta the day Dell announced it.

Dell’s vision for its Cloud Marketplace is similar to that of Priceline or Kayak in the travel business. Dell will aggregate, simplify and streamline shopping, selection, purchase and management across many cloud service options. Cloud offerings will initially be sold through Dell.com, Dell’s established, high volume direct sales channel. Over time, Dell is likely to implement reseller programs and possibly even white-label programs for channel partners.

Perspective

Perception is the hardest thing to change. With deep, successful roots in the hardware business, they company has been primarily regarded as a hardware vendor, even though its journey to become an end-to-end solutions provider has been underway for quite a while.

Dell’s move to become a broker of cloud services, highlight the acquisitions, research, development and determination that Dell has been investing in this quest. And, with cloud adoption now mainstream (Figure 1), Dell’s timing for the marketplace is on target as well. The cloud makes it easy for people to buy new services, and more difficult for IT to manage the wide variety of different services that are in play. Providing a solution that gives IT managers more visibility and governance capabilities, while at the same time offering users more choice, promises to help address this challenge.

Figure 1: SMB Cloud Adoption

Source: SMB Group

However, due in part to the uniqueness of the model, Dell will need to invest in market education to articulate the capabilities and benefits of this new brokerage approach more clearly.

In addition, Dell must create a clear roadmap for what and when it will add to the marketplace to properly set market expectations. For instance, one of the customers I spoke to at the beta would like to use the marketplace to help him manage the wide range of file sharing and collaboration solutions that his users are buying.

Finally with Dell partners accounting for an increasing percentage of Dell sales, Dell will need to come up with an attractive approach to lure partners to resell Dell Cloud Marketplace services.

Disclosure: Dell paid for most of my travel expenses to attend Dell World.