By Kelly Teal, Contributing Analyst, and Laurie McCabe, Cofounder, SMB Group

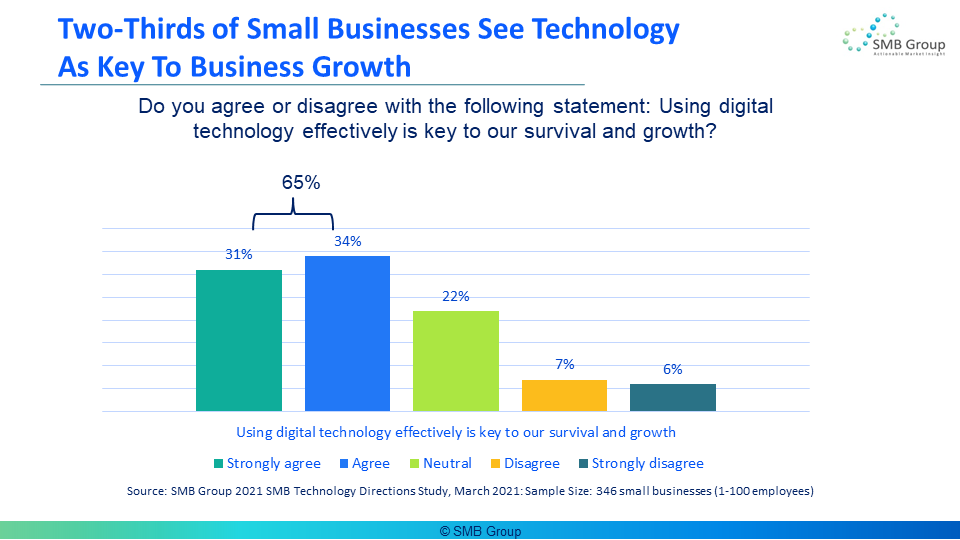

SMB Group research shows that small businesses (1–100 employees) increasingly understand the importance of putting technology to work for their businesses: 65% agree that using technology effectively is critical to business success.

Fortunately, the cloud has made it much easier for small businesses to access the new applications they need to help their businesses get ahead. However, integrating them isn’t always so straightforward. In our surveys, small business decision-makers repeatedly cite “integration difficulties” as one of the top three obstacles they face in implementing new solutions.

When applications don’t connect with each other, information falls through the cracks, people spend too much time doing things manually, and it’s difficult to get a holistic view of customers and the business. On the flip side, when apps are integrated, information automatically flows between them. Employees can get consistent, comprehensive information in one place, respond more quickly to requests for information, and make better decisions.

Many small businesses struggle with manual Excel file uploads or custom code to patch different applications together. But these alternatives are often time-consuming to build, manage and maintain as the business incorporates new processes and adds new applications.

As a result, more small businesses are looking for pre-built connectors up front, as part of the solution selection process, to automate application integration: 55% say that it is extremely important or important for vendors to have pre-built connectors or integrations to other solutions as part of the solution package. And when you think about it, what business wouldn’t want to be able to have a more unified view of the business, not only to make better decisions but also to present a more professional image to customers?

In this post, we look at how Winthrop Wealth, a Boston-headquartered wealth management firm, took advantage of Salesforce’s Sales Cloud, Financial Services Cloud, and AppExchange to pull all of the information that its financial advisors need into one place — and deliver faster, more responsive and intelligent services to its customers.

Winthrop Wealth’s Information Bottleneck

Winthrop Wealth was founded in 2017 by brothers Mark and Earl Winthrop, who started in the financial industry back in the 1980s. Today, the business employs 22 people who manage about $1.83 billion worth of assets for their clients.

Winthrop Wealth’s advisors provide high net-worth clients with multiple services, including help with financial planning, tax planning, building portfolios, constructing portfolios, trades, and staying on top of client life events and portfolio modifications that need to be made. In addition, they need to monitor how each portfolio is performing, and interact with clients to report performance and discuss adjustments. Clients expect more than monthly or quarterly meetings — they check in regularly with advisors to see how their portfolio is doing.

About five years ago, the company was joined by Earl’s two sons, Lucas and Max Winthrop. At the same time, Winthrop Wealth was also bringing in the next generation of clients to its business. They were concerned that their existing technology stack wasn’t up to the task of supporting the business’ future growth goals. Winthrop Wealth wanted to put a technology platform in place that would help advisors to deliver highly personalized financial guidance to an expanding and more demanding customer base.

The company didn’t have a dedicated technology manager to examine how to optimize its technology stack to best support the business. As a result, people were deploying and using technology in an ad hoc manner. While the company had deployed Salesforce Sales Cloud and Financial Services Cloud it was running two separate books of business, and advisors were also using Outlook and spreadsheets to store client information.

This meant that advisors spent a lot of time manually aggregating data from different information silos. They had to log into one system to view some of their accounts, log into another system to see others, check a third system to see what their target asset allocation should be, and pull up spreadsheets for other information.

Empowering Advisors with Integrated Solutions

Winthrop Wealth leadership hired Michael Banchick to build a technology platform to empower advisors with streamlined access to information to provide its customers with personalized care and attention.

According to Banchick, “Being able to bring the information together, put it all under one roof and move to more of an ensemble model is really important. In the highly regulated financial services industry, it’s also essential that advisors and the company adhere to strict compliance with government regulations concerning financial and personal information. We needed one place where advisors could get a secure, holistic view of each client’s holdings.”

Banchick’s first order of business was to consolidate the two different Salesforce Sales and Financials Cloud systems the company had been using, along with information from other databases, into a newly configured, unified Salesforce Sales and Financials Cloud platform. As Banchick reflected, “The original setup worked, but not in a way that helped the advisors to do their jobs better, to be more proactive and elevate the client experience. It was a big data effort to consolidate and merge duplicates and then put in validation steps so that, going forward, when advisors entered new clients into the system, they had to enter all of the required data. But it had to be done.”

The next priority was to integrate a portfolio performance management tool designed for the financial services industry. Winthrop Wealth had been using one for several years, paying consultants and integrators for custom integration with its old Salesforce systems, and employing one staff member who was dedicated to producing reports for clients.

Now, Banchick needed to get the financial information from this legacy performance management system into the newly configured and consolidate Salesforce platform. Since there was no ready-made integration between the two, he’d need to hire a third-party agency to build a custom integration.

While custom integrations can work, they can also be riddled with problems. As Banchick states, ‘It takes you away from your business. It’s a lot of overhead to maintain over time, which can have a real negative impact on operations if you’re not careful.” And, when the company took a hard look at things, it determined that the integration would cost hundreds of thousands of dollars, they’d need to spend more money to manage it, and they might even need to hire someone just to monitor and troubleshoot it.

This analysis resulted in Banchick getting the green light to see what other performance reporting tools were out there that might be a better fit. One of the things that Banchick put at the top of his checklist was whether these solutions had a pre-built integration into Salesforce.

Enter AppExchange and Addepar

Through his research, Banchick discovered Addepar in Salesforce’s AppExchange. Addepar fit the bill in terms of providing a solution to aggregate client data and deliver reporting and analytics — and had built an integration with Salesforce. By syncing Addepar’s portfolio holdings and ownership structure to Salesforce, Winthrop Wealth would have access to all aggregated data in a single, cohesive view without the need for cumbersome custom integrations.

Banchick learned that the Addepar solution would also take care of financial industry compliance requirements. This meant that Banchick wouldn’t have to seek out an additional solution or hire a third-party integrator to craft another custom integration.

The AppExchange seal of approval was another big selling point to select Addepar. Salesforce tests AppExchange solutions to make sure they are safe and secure, and takes steps to make vet them for financial solvency. “I’m always looking for high-fidelity partners that take security seriously, that aren’t fly-by-night vendors. If we’re trusting them with our clients’ information, we need to make sure that we don’t end up with egg on our face because they are lax and have a data breach,” noted Banchick.

Building a Foundation for the Future

Winthrop Wealth was one of the first Salesforce clients to use Addepar via AppExchange. The pre-built integration allowed Banchick to get a proven, all-in-one platform off the ground quickly. Now, advisors have the information they need, at their fingertips in one place, enabling them to provide clients with more accurate and holistic information.

Throughout the past five years, the partnership between Salesforce and Addepar has given Banchick “peace of mind.” The two vendors jointly take feedback from users, including Winthrop Wealth, to further hone their offerings, “collaborating and talking to each other or working with each other to continually make this solution better,” Banchick said.

Winthrop Wealth has since turned to AppExchange for other solutions as well. “One of our favorites is from a company called Handwrytten, which sends out handwritten birthday cards to all of our clients,” Banchick added.

Perspective

In today’s business world, small businesses can’t afford siloed applications. Pre-built integrations move data between applications and connect workflows — improving productivity and streamlining business processes. As important, they help decision-makers see the big picture — providing insights to identify and respond to new opportunities or potential problems more quickly and easily.

As Winthrop Wealth’s story illustrates, by making integration capabilities a priority in the application selection process, small businesses can reap these benefits more quickly, easily, and cost-effectively than if integration is an after-thought.

Salesforce’s seventeen-year-old AppExchange has been a pioneer in this area. It’s now the biggest B2B applications marketplace, with more than 7,000 applications, and over 10 million application installs. In March the company unveiled a new design, search, and personalization capabilities that make it even easier for customers to find new solutions that easily integrate with the Salesforce platform.

As important. Salesforce also vets partners for a range of capabilities, including security, functionality, adequate support processes, and load testing to ensure the integration can support high data volumes. This not only saves customers time and effort — but helps to avoid complications and mitigate risks.

The result, also evidenced by Winthrop Wealth’s experience, is more time to focus on building the business and providing a better experience for customers. That means a lot to Banchick. “As a small business, I’m not alone…I have trusted partners, and it’s not 100% on me.”

©SMB Group, 2022

Source: Laurie McCabe’s Blog