Technological change is accelerating at a frenetic pace—and with dramatic impact. It’s reshaping customer expectations, employee requirements and attitudes, and disrupting business practices, models and entire industries.

While no one will ever be able to predict what’s next with complete certainty, businesses that can adapt in response to or even in anticipation of changing conditions will certainly fare better than those that can’t. This reality is driving strong SMB adoption of modern, flexible cloud business applications which provide a real-time view into the business and the ability to compete effectively in the digital age.

But adoption of cloud-based accounting and financials and has lagged in comparison with other application categories. Given that accounting and financials are the systems of record for most businesses—and intertwined with almost every other core business function—finance and business leaders that stick with legacy solutions—often mired in hard-coded customizations and integrations—increasingly do so at their own risk.

The Cloud Is the On-Ramp to Innovation and Growth

SMBs’ appetite for cloud or software-as-a-service (SaaS) solutions has risen steadily over the years—and for good reason. Cloud providers own and manage infrastructure and applications and supply implementation, ongoing management and service, a steady stream of application updates, and security levels that most SMBs would be hard-pressed to match on their own. The cloud model also offers flexibility, ease of use, speedier deployment, and financial and budgeting benefits over traditional on-premises alternatives.

Twenty-plus years after the first cloud-based business applications launched, the model is no longer novel. However, leading cloud providers are now extending the cloud value proposition with new capabilities to make it even more compelling.

Because modern cloud solutions are built on open, flexible platforms, providers can embed new technologies—such as artificial intelligence and machine learning, blockchain, natural language processing, internet of things (IoT), and more—into their solutions much more easily than would be possible with older, more brittle software.

Instead of having to learn about, evaluate, select, purchase, and integrate new technologies on your own, you can access many of these new capabilities directly within the cloud business solutions you already use.

Accounting and Financials: Poised for a Cloud Surge

Adoption of cloud accounting and financials has been slower than in other solution areas, but is poised to surge.

Adoption of cloud accounting and financials has been slower than in other solution areas, but is poised to surge.

As SMBs get comfortable with the cloud, many realize that they need as much—if not more—agility in the financials area as required in other parts of the business.

Cloud-based financials solutions, such as Sage Intacct, are designed to help companies automate existing processes, integrate with other key solutions, and provide a more comprehensive view of what’s going on in the business.

They offer a consistent, real-time view of the business. All of your business-critical information is updated in real-time and stored in a unified database, so it can flow easily between different financial workflows. This helps to dramatically reduce redundant manual data entry, speed up repetitive processes such as billing and closing the books, and provides “one version of the truth” to facilitate collaboration and decision-making. Proactive alerts and notifications, also based on real-time data, alert you to potentially risky situations.

This same open framework helps support new initiatives and business models that SMBs need to grow. Providers are starting to embed new artificial intelligence (AI) and machine learning (ML) capabilities into their offerings, which will take automation and analytics to new levels. For instance, Sage Intacct is working on continuous audit functionality, which will replace labor-intensive, one-off manual audits with real-time continuous, course-correcting audits powered by AI and ML.

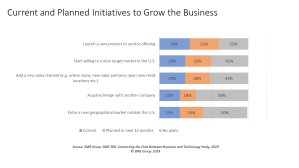

Whether you’re entering a new market, adding a new subscription-based revenue model, or building a new channel, the ability to add new workflows and to plan, track, and manage new sales and revenue information for these initiatives is essential.

Whether you’re entering a new market, adding a new subscription-based revenue model, or building a new channel, the ability to add new workflows and to plan, track, and manage new sales and revenue information for these initiatives is essential.

Modernize Today, Get on Solid Footing for Tomorrow

Change is hard. But what is the cost to your business if you can’t adapt? If your current financial system is a drag on the business today, it may bring it to a halt tomorrow.

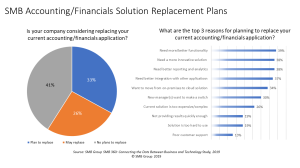

In fact, one-third of SMBs are planning to replace their current accounting and financial management solutions. The top drivers include requirements for additional functionality, a more innovative solution, improved reporting and analytics, better integration with other solutions, and the desire to move to a cloud-based solution.

In fact, one-third of SMBs are planning to replace their current accounting and financial management solutions. The top drivers include requirements for additional functionality, a more innovative solution, improved reporting and analytics, better integration with other solutions, and the desire to move to a cloud-based solution.

Take an honest look at whether the financials solution you’re using today is helping you move ahead or putting you further behind. Evaluate what’s broken, how to fix it, and what you need to put the business on solid footing for the future.

For most companies, that starts with automating and modernizing existing processes with a cloud-based financial solution. For instance:

- Dataxu, an advertising and analytics platform serving 700 brands in 11 countries, faced several issues. It was taking them up to 120 days to collect on customer receivables and 20 days to close the books. They had no visibility into campaign-level profitability. Deploying Sage Intacct’s cloud-based financials solution helped them to speed up collections with automated, usage-billing, resulting in a $40 million increase in operating cash. The company was also able to reduce the month-end close to 8 days, and gain P&L visibility by campaign and country.

- Halstatt, a family-owned investment firm, was spending too much time—over 100 hours per quarter—on consolidated financial reporting. It was unable to readily gauge investment performance and spending too much time and money processing 400+ vendor payments per month. Using Sage Intacct, the company can now create a consolidated financial report in minutes and quickly evaluate investment performance through automated consolidation. It has also lowered the cost for check processing from $36 to $3.96 per check.

- Hopi Tribe Economic Development Corp. is the economic development arm for the Hopi Tribe in Northern Arizona. With multiple hospitality businesses serving travelers along Old Route 66, the organization was losing cash from diesel fuel and restaurant sales, had no visibility into entity-level profitability, and had limited understanding of consolidated performance. Since implementing Sage Intacct, it has gained the insights it needed to increase gross margin by 20%, generate more than $500K in additional cash flow, and recognize a $5M increase in real estate asset value.

Perspective

Solving for your most pressing problems with cloud-based financials today also puts you on solid ground to reshape the business and innovate for tomorrow. With real-time information and visibility into business metrics at your fingertips, it’s easier to assess trends, improve decision-making, and to measure and improve on outcomes. And you’ll be able to add new workflows, integrate other data sources, and take advantage of new technologies as you need them—without having to start from scratch.

The rate and pace of change will only continue to accelerate. Now is the time to make sure that you’ve got the technology backbone you need to iterate, improve, and keep pace.

This is the first post in a three-part blog series sponsored by Sage Intacct that examines top technology and business trends for SMBs, and their impact on finance and accounting. It was originally published here.

© SMB Group

Source: Laurie McCabe’s Blog